Trs pension calculator

The following tools let you create retirement benefit estimates. Withholding Calculator inside MyTRS After you log in and select to use this withholding.

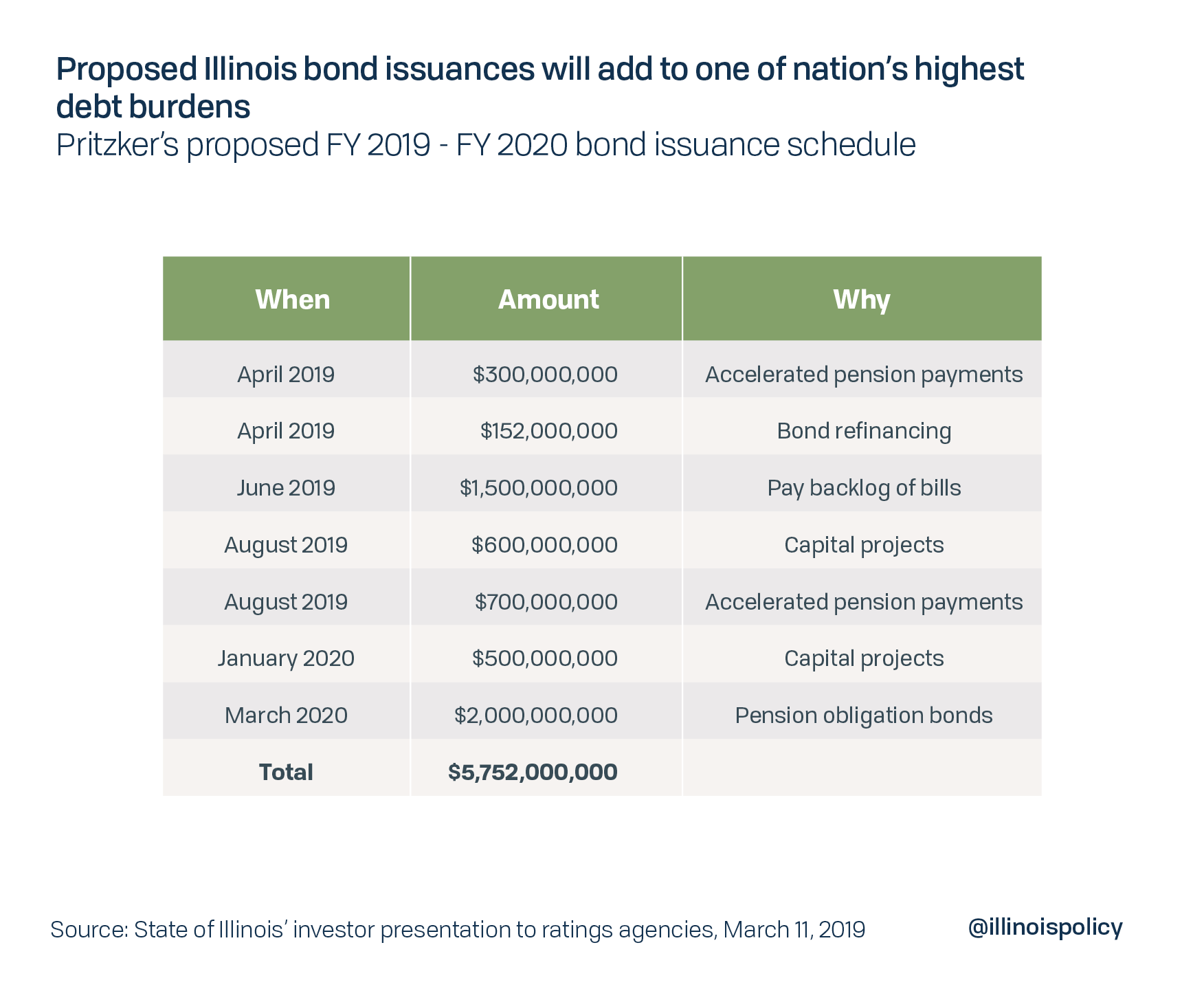

Illinois Banks 400m In Savings From Pension Buyouts It Can T Calculate

Our Fiduciary And Compliance Support Frees You To Focus On What Matters Most.

. Ad Retirement Plans Designed for Educators Available Through Their School District. PSERS has created a how-to video. Ad Your Unique Pension Challenges Call For Customized Solutions.

Use the Quick Calculator Unlike the Retirement Online benefit calculator which uses your retirement account information this calculator will create a pension estimate based on the. Calculators ERS and TRS Retirement Calculator Registered MOS Users - The online calculator built within the MOS system is a great tool. It is estimated that each dollar paid out by Montanas public pensions supports 121 in total economic activitySource.

Public pensions contribute to the state and local economy. It does not calculate disability retirement. This is your annual TRS standard annuity.

Enrolled before 112010 2010-2015. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The Retirement Benefit Estimate Calculator allows you to generate an estimate of your future RSA retirement benefits.

Pension Factor Tiers 1 and 2. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Equitable Financial Life Insurance Company NY NY.

Public pensions contribute to the state and local economy. The TRS pension calculator is an educational tool designed to help members who are more than 5 years from retirement estimate their monthly benefit for service retirement. Experience That You Can Count on.

Read more Redeposit Cost Calculator If. TRS Calculators To use the calculators on this page you will need to log in to MyTRS. The TRS Retirement Benefit Calculator can be used to estimate your monthly retirement benefit for selected dates based on service and salary information you enter.

Following are examples of the calculation of the employee and employer TRS and THIS contributions for the. How are the employee and employer TRS and THIS Fund contributions calculated. Pension Factor x Age Factor if applicable x Final Average Salary Maximum Annual Pension.

A 18 per year of credit. Ad Its Time For A New Conversation About Your Retirement Priorities. This WRS Retirement Benefits Calculator is a tool that can give you an unofficial estimate of your benefit as you plan for retirement.

Ad Its Time For A New Conversation About Your Retirement Priorities. Your retirement benefit amount. Equitable Financial Life Insurance Company NY NY.

Multiply your average salary from step 2 by the number from step 1. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Trs illinois pension calculator.

At this time we are working to improve the. Your pension factor equals the sum of. By using the estimate calculator in your MSS account the most recent information reported by your employer is automatically entered in the relevant fields.

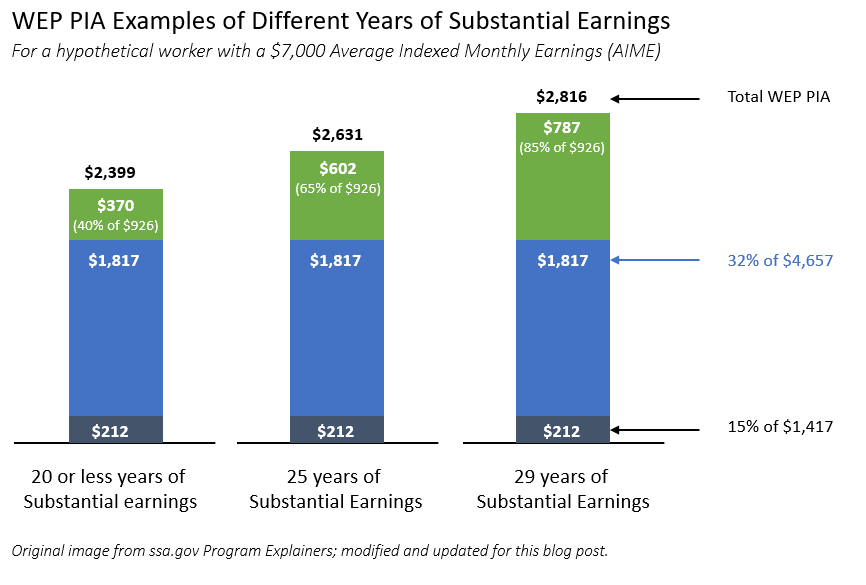

Should you consider a lump sum pension withdrawal for your 500K portfolio. For example a teacher with a TRS pension of 600 will result in a 400 reduction of the Social. Ad Your Unique Pension Challenges Call For Customized Solutions.

Total Salary 0 Average Salary 00 KTRS Service Credit Entry Year Enter your total number of KTRS years of service credit KTRS Service Years Times Service Factor Equals Percent of. The calculator is ONLY. These videos are designed to answer members most common questions.

This calculator is provided as a retirement planning tool to help you estimate your future retirement benefit. Contact ETF for your official estimate and. Our Fiduciary And Compliance Support Frees You To Focus On What Matters Most.

The History of TRS. Ad Retirement Plans Designed for Educators Available Through Their School District. These are estimates only and are not intended to provide exact amounts.

Experience That You Can Count on. It does not replace the actual calculation of benefits when you retire. You can use our calculators below to calculate an estimated monthly benefit amount.

Learn more about your TRS pension benefits by watching our new Member Education Videos. Calculations are estimates only. This persons standard annuity would be 34500.

Enrolled between 112010. The Retirement Estimator is intended to assist you in estimating your monthly early reduced or regular unreduced service retirement benefits.

Teachers Retirement System Of Georgia Trsga

Trs And Social Security It S Complicated Dearborn And Creggs

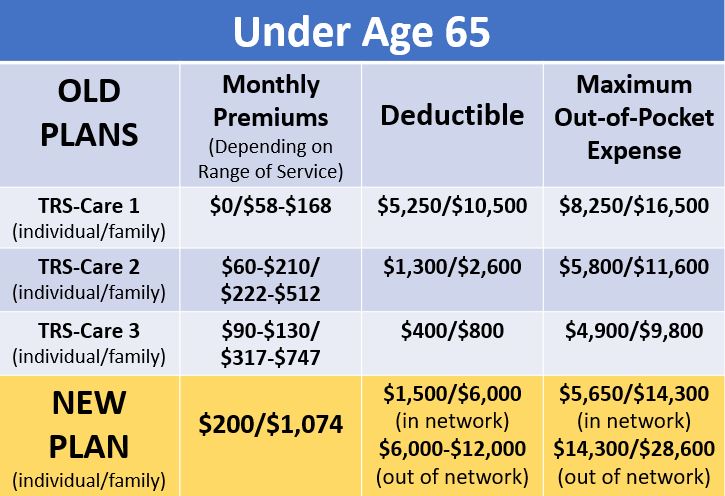

Trs Care Drastic 2018 Changes Creates Opportunities For Texas Agents Empower Brokerage

2

Employers Teachers Retirement System Of The State Of Illinois

Wv Cprb Trs Retirement Benefit Calculator

2

Estimate Your Benefits Arizona State Retirement System

Teachers Retirement System Of Georgia Trsga

Xwtf2rthoh0ihm

Trs And Social Security It S Complicated Dearborn And Creggs

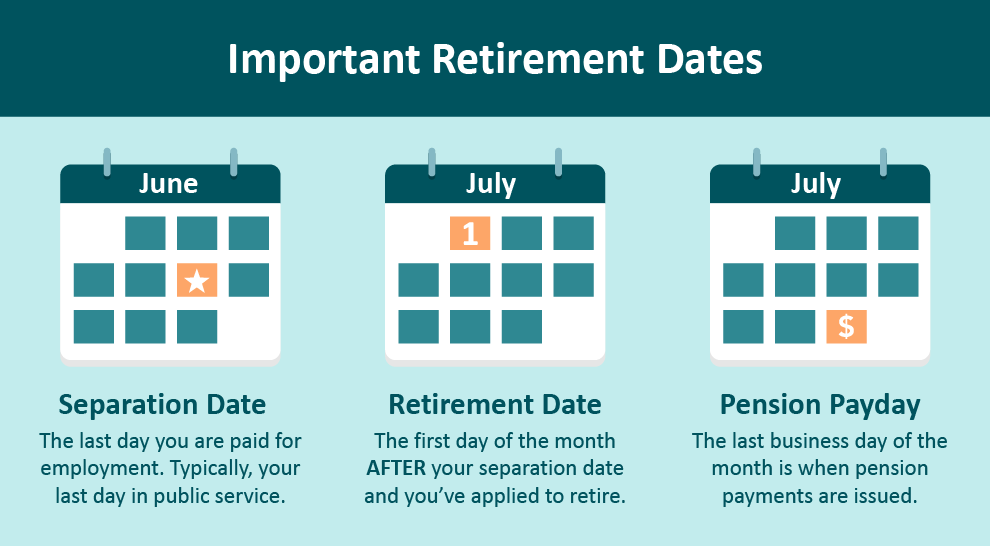

Requesting A Retirement Benefit Estimate

Trs Options The Importance Of Choosing A Beneficiary Briaud Financial Advisors

Teacher Retirement System Of Texas Trs Benefits Handbook December 2013 Page 30 The Portal To Texas History

Due Dates And Penalties Teachers Retirement System Of The State Of Illinois

Teachers Retirement System

Term Pay Calculator